How do the number of purchase options affect our buying process? According to the economic theory, more choice, due to preference matching, always has a positive effect on a buyer. Psychologically however, there is a choice conflict and choice overload. Too much is demotivating. The experiment in which I participated at Imperial College London provided evidence to support the idea that rather than facilitating our decision making process, having more products to chose from actively leads to choice fatigue.

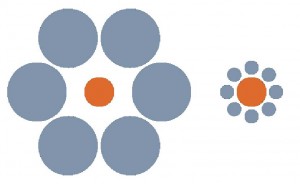

One of the most fundamental techniques for display and pricing is known as the Attraction Effect. Products subject to sale become more or less attractive in the context of other superior or inferior products. Making a choice between two similar objects is hard.

The choice is easier to make when there is another product added to the choice list. The middle option is usually the winner.

By adding an inferior product to the list of choices available to the buyer we can facilitate the choice making process. The consumer perceives the products originally listed on the choice list as superior and finds choosing the right product easier. Junk options make the alternatives look good.

Compromise Effect – a set of three choices can be stretched upwards if the entire set is compared to another similar set with a salient end option.

————————————-

Formula for Choice Illusion:

Downward Stretch

1st Set: A B C

1st choice 2nd choice

2nd Set: E F G

Upward Stretch

References

- Maciejovsky, B., 2012. Choice Illusion, Consumer Behaviour. Imperial College London, unpublished.

Written by Michael Pawlicki